AI Fraud In today’s digital world, many things happen online, like shopping, banking, and gaming. Unfortunately, some people try to trick others and steal money or information. This is called fraud. But don’t worry—AI (Artificial Intelligence) is here to help. AI can quickly spot these tricks and stop them before they cause harm.

Tackling Fraud with AI Using AI in fraud detection is like having a super-smart helper that watches over everything. It looks for unusual patterns and warns us if something seems wrong. This makes it easier to keep our online activities safe and secure.

What We’ll Cover In this blog, we’ll explore how AI helps detect fraud, the common uses of AI in stopping fraud, and how businesses can use AI to stay safe. We’ll also look at real-life examples and some challenges AI faces in this fight.

Table of Contents

What is AI in Fraud Detection?

AI, or Artificial Intelligence, refers to computer systems designed to mimic human intelligence. These systems can learn from data, recognize patterns, and make decisions without human intervention. In fraud detection, AI helps identify suspicious activities that may indicate fraud.

Fraud detection involves identifying activities that are dishonest or illegal. This can include things like credit card fraud, identity theft, and insurance fraud. Traditional methods of detecting fraud relied on human analysis and basic rules, but with the advent of AI, the process has become more accurate and efficient.

The Role of AI in Fraud Detection

Why AI is Important

AI plays a critical role in fraud detection by quickly analyzing vast amounts of data and identifying patterns that humans might miss. This speed and accuracy are essential in detecting fraud before it causes significant damage.

How AI Enhances Security

AI helps by constantly monitoring transactions and activities in real-time. It can flag unusual behavior, such as multiple transactions from different locations in a short time, which may indicate fraudulent activity. By doing this, AI not only detects fraud but also prevents it from happening.

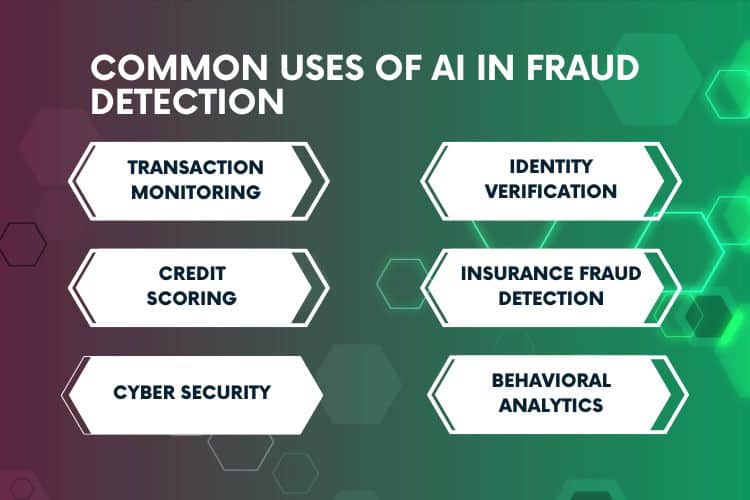

Common Uses of AI in Fraud Detection

1. Transaction Monitoring

AI is widely used to monitor transactions for signs of fraud. It can analyze millions of transactions in seconds, looking for anomalies that could indicate fraudulent behavior.

2. Identity Verification

AI helps verify identities by analyzing various data points, such as facial recognition or voice patterns, ensuring that the person making a transaction is who they claim to be.

3. Credit Scoring

AI improves credit scoring by analyzing a broader range of data, including social media activity and transaction history, to provide a more accurate assessment of creditworthiness, helping to reduce the risk of fraud.

4. Insurance Fraud Detection

AI helps insurance companies detect fraud by analyzing claims for patterns that suggest dishonesty, such as exaggerated injuries or staged accidents.

5. Cybersecurity

AI is crucial in cybersecurity, where it helps detect and prevent online fraud, such as phishing attacks or unauthorized access to accounts.

6. Behavioral Analytics

AI can analyze the behavior of users over time, learning what is normal and flagging any deviations that might indicate fraud.

How AI Detects Fraud

Pattern Recognition

AI excels at recognizing patterns in data. For example, if a credit card is suddenly used in a different country, AI can detect this unusual behavior and flag it as potentially fraudulent.

Machine Learning

Machine Learning, a subset of AI, allows systems to learn from past data and improve over time. In fraud detection, this means that the more data AI has, the better it becomes at spotting fraud.

Predictive Analytics

AI uses predictive analytics to forecast potential fraudulent activities before they happen. By analyzing trends and patterns, AI can identify risk factors and take preventive measures.

AI-Powered Fraud Solutions and Implementation

Implementing AI in Businesses

To effectively implement AI in fraud detection, businesses need to integrate AI tools with their existing systems. This requires collaboration between AI experts and industry professionals to tailor solutions that meet specific needs.

Training AI Systems

AI systems need to be trained using large datasets to accurately detect fraud. This training involves feeding the AI data on past fraudulent and non-fraudulent activities so it can learn to distinguish between them.

Continuous Improvement

Once implemented, AI systems must be continuously updated with new data to stay ahead of emerging fraud tactics. This ensures that AI remains effective in detecting and preventing fraud.

Monitoring and Evaluation

After implementing AI in fraud detection, businesses must regularly monitor and evaluate the system’s performance. This involves checking how well the AI is identifying fraudulent activities and making adjustments as needed. Regular monitoring helps ensure that the AI system remains accurate and efficient, and it also allows businesses to identify any areas where improvements can be made.

Scalability

As a business grows, its AI-powered fraud detection system should be able to scale accordingly. This means that the AI system must handle increasing amounts of data and more complex fraud scenarios as the company expands. Scalability ensures that the AI system can continue to protect the business effectively, even as the volume of transactions and potential fraud risks increase.

Real-World Examples of AI in Fraud Detection

Example 1: PayPal

PayPal uses AI to monitor transactions and detect fraudulent activities in real-time. By analyzing user behavior and transaction patterns, PayPal’s AI system can quickly flag and prevent potential fraud.

Example 2: Credit Card Companies

Credit card companies like Visa and Mastercard use AI to detect unusual spending patterns. If a card is suddenly used in a location far from the cardholder’s usual area, AI can flag the transaction for further investigation.

Example 3: Online Retailers

Online retailers use AI to prevent fraud during transactions. For instance, Amazon uses AI to analyze purchasing behavior and detect potential fraud, such as multiple purchases from different accounts using the same credit card.

Benefits of AI in Fraud Detection

Improved Accuracy

AI significantly improves the accuracy of fraud detection by analyzing large amounts of data quickly and identifying patterns that might go unnoticed by humans.

Cost-Effective

Implementing AI in fraud detection can be cost-effective in the long run. By preventing fraud, businesses save money that would otherwise be lost to fraudulent activities.

Real-Time Detection

AI’s ability to analyze data in real-time means that fraud can be detected and prevented almost instantly, reducing the impact of fraudulent activities.

Challenges of AI in Fraud Detection

Data Privacy Concerns

One of the challenges of using AI in fraud detection is ensuring that data privacy is maintained. Businesses need to implement strict data protection measures to ensure that personal information is not misused.

Evolving Fraud Tactics

As AI systems become more advanced, so do the tactics used by fraudsters. AI must continuously evolve to stay ahead of these new methods.

High Initial Costs

The initial cost of implementing AI can be high, especially for smaller businesses. However, the long-term benefits often outweigh these costs.

Related Topics

AI in Cybersecurity

Explore how AI is revolutionizing cybersecurity by detecting and preventing online threats, ensuring safer digital environments for businesses and individuals alike.

Machine Learning and Fraud Detection

Delve into the role of Machine Learning in fraud detection, understanding how it enables AI systems to improve over time by learning from past data and experiences.

Conclusion

AI in fraud detection is a powerful tool that helps businesses and individuals protect themselves from fraudulent activities. By recognizing patterns, analyzing behavior, and continuously learning, AI can detect and prevent fraud with greater accuracy and speed than traditional methods. As technology continues to evolve, AI will play an increasingly important role in keeping our financial systems safe from fraudsters.